rhode island state tax withholding

To have forms mailed to you please call 4015748970. Lets say you sell an investment property in Rhode Island but live in Connecticut.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Fiduciary Income Tax Forms.

. 505 Tax Withholding and Estimated Tax. You must complete Form RI W-4 for your employers. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table.

This article is part of a series on. However if Annual wages are more than 241850 Exemption is 0. Withholding tax forms now contain a 1D barcode.

Pass-through entities are also subject to RI. Income tax withholding account including withholding for pensions or trusts Rhode Island Unemployment insurance account including Rhode Island temporary disability insurance TDI and Rhode Island job development fund tax. The annualized wage threshold where the annual exemption amount is eliminated.

Personal Income Tax Forms. RI Division of Taxation Registration Section 401-574-8829 - withholding and sales tax registration only questions. State of Rhode Island Division of Taxation Employees Withholding Allowance Certificate.

You may claim exemption from withholding for 2022 if you meet both of the following conditions. 2022 New Employer Rate. Human Resources - 330 Whitmore Building - 181 Presidents Drive - Amherst MA 01003 - Contact - Site Map.

However if Annual wages are more than 231500 Exemption is 0. You set up your. Rhode Island corporate from 1947.

Up to 25 cash back File Scheduled Withholding Tax Payments and Returns. Ad Download or Email RI RI W-4 More Fillable Forms Register and Subscribe Now. PPP loan forgiveness - forms FAQs guidance.

Your payment schedule ultimately will depend on the average amount you hold from employee wages over time. Latest Tax News. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

2022 Filing Season FAQs - February 1 2022. The purpose of this Part is to implement RI. Multiply the adjusted gross biweekly wages times 26 to obtain the gross annual wages.

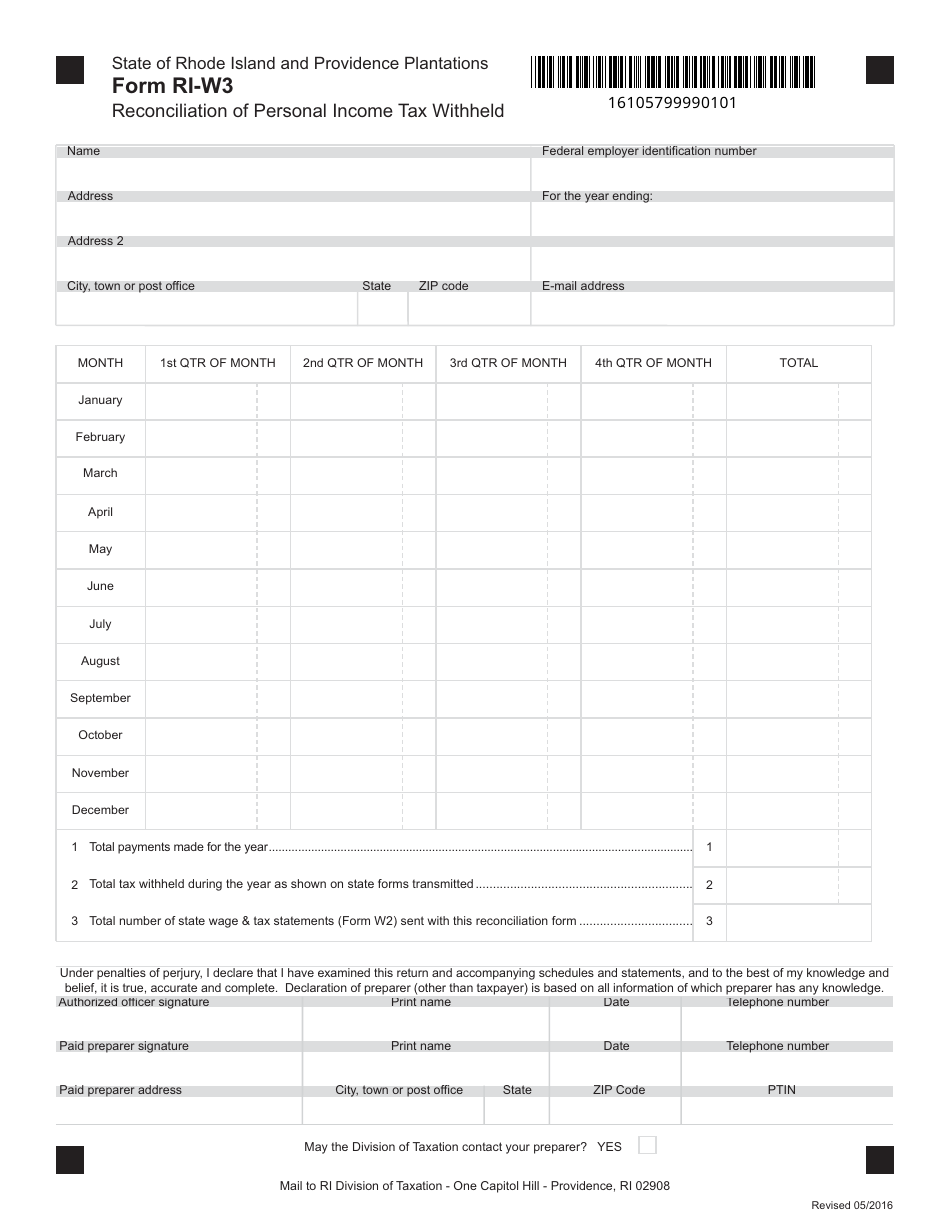

REPORTING RHODE ISLAND TAX WITHHELD. State of Rhode Island. Rhode Island Taxable Income Rate.

Daily quarter-monthly monthly quarterly and annually. Divide the annual Rhode Island tax withholding by 26 to obtain the. RI Employer Tax Section 401-574-8700 Option 1 - unemployment and TDI.

You had no federal income tax liability in 2021 and you expect to have no federal income tax liability in 2022. The Territory of Alaska then Alaska as a state individual and corporate from 1949. Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding.

Laws 44-30-713 which provides for withholding of income tax on the sale of real estate by nonresidents. Taxation in the United States. Federal Form W-4 can no longer be used for Rhode Island withholding purposes.

Office of the Governor Secretary of State RIgov Elected Officials State Agencies A-Z State. Employers must report and remit to the Division of Taxation the Rhode Island income taxes they have withheld on the following basis. The income tax withholding for the State of Rhode Island includes the following changes.

Top Marginal State Income Tax Withholding Rate. To view tax forms for previous years please go to our Prior Year Personal. In Rhode Island there are five possible payment schedules for withholding taxes.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. Laws 44-11-22 which requires income taxes to be withheld at the highest income tax rate currently 599 for individuals or 7 for corporations for income attributable to this state for non-resident membersshareholderspartners. Masks are required when visiting Divisions office.

The income tax withholding for the State of Rhode Island includes the following changes. Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if. The income tax withholding for the State of Rhode Island includes the following changes.

All forms supplied by the Division of Taxation are in Adobe Acrobat PDF format. Nonresident Real Estate Withholding Forms. If you are not a resident of Rhode Island or a corporation that isnt formed in Rhode Island the buyer of your property will have to file income tax on your behalf.

Divide the annual Rhode Island tax withholding by 26 to obtain the. Thank you for using the Rhode Island online registration service. If your state tax witholdings are greater then the amount of income tax you owe the state of Rhode Island you will receive an income tax refund check from the government to make up the difference.

Rhode Island has what is called a non-resident withholding tax in order to capture the income tax on the sale of a property. Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding. Withholding and when you must furnish a new Form W-4 see Pub.

Read the summary of the latest tax changes. Once you have completed Form RI W-4 for your employer Form RI W-4 only needs to be completed if you are making changes to your withholding allowance or. The table below shows the income tax rates in Rhode Island for all filing statuses.

The Rhode Island state income tax is based on three tax brackets with lower income earners paying lower rates. WEEKLY - If the employer withholds 600 or more for a calendar month. Individual tax forms are organized by tax type.

Select the tax type of the form you are looking for to be directed to that page. UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI state taxes should be calculated and withheld. RI Division of Taxation.

By election of the installment method the seller agrees to make such estimated payments and to file all appropriate Rhode Island tax returns for years following the year of sale. Multiply the adjusted gross biweekly wages times 26 to obtain the gross annual wages. 26100 for those employers that have an experience rate of 959 or higher Employers will be notified in late December of their individual tax rate.

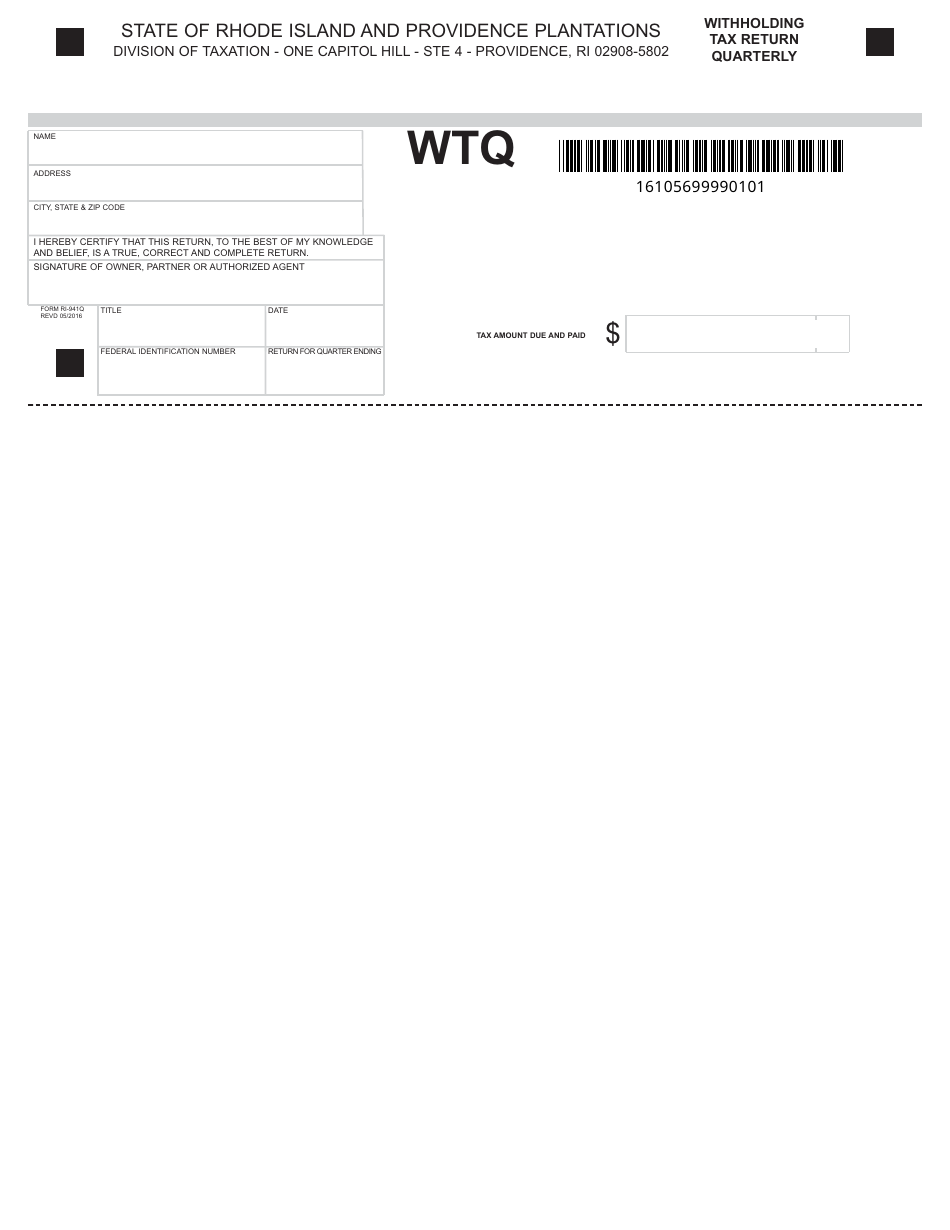

Form Wtq Download Fillable Pdf Or Fill Online Withholding Tax Return Quarterly Rhode Island Templateroller

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

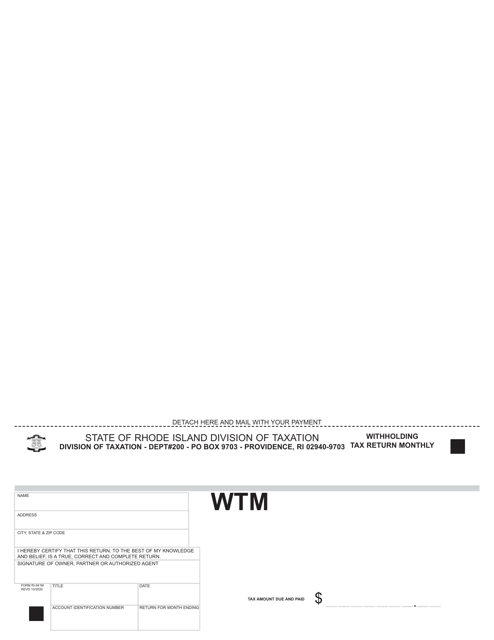

Form Ri 941m Download Fillable Pdf Or Fill Online Withholding Tax Return Rhode Island Templateroller

Tax Withholding For Pensions And Social Security Sensible Money

Improved Tax Withholding Estimator Now Available Pg Co

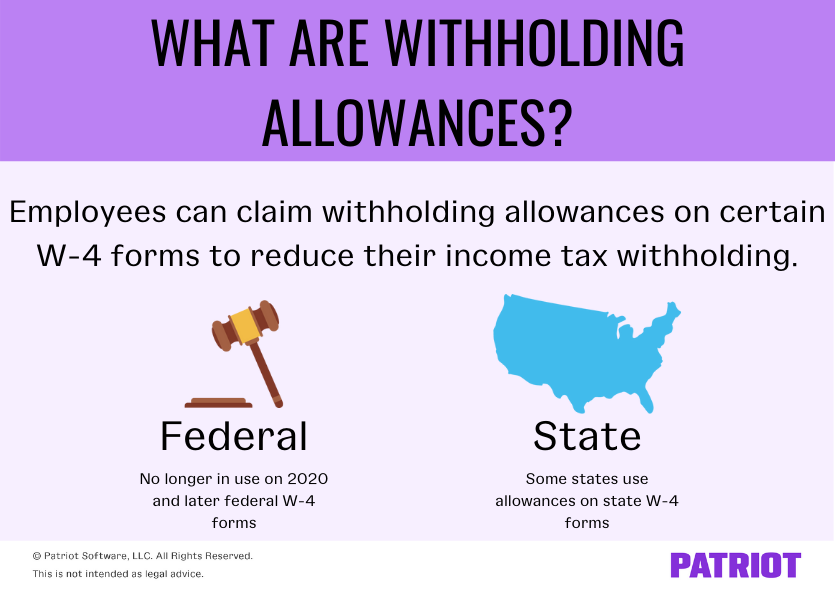

Withholding Allowances Payroll Exemptions And More

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

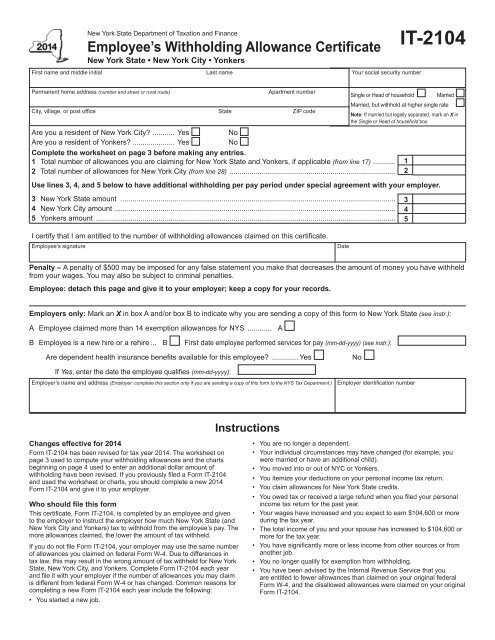

Form It 2104 New York State Tax Withholding South Colonie

State Of Rhode Island Division Of Taxation Division Rhode Island Government

How Your State Tax Withholding May Have Been Affected G A Partners

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

Irs Form 945 How To Fill Out Irs Form 945 Gusto

Form Ri W3 Download Fillable Pdf Or Fill Online Reconciliation Of Personal Income Tax Withheld Rhode Island Templateroller

New W 4 Irs Tax Form How It Affects You Mybanktracker

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

State Of Rhode Island Division Of Taxation Division Rhode Island Government